As we face the bitter annual battle about increasing the debt limit, it is interesting to take a look at how we got here and what could be done to improve the situation.

The current national debt is approximately $31.5 trillion. Our budget deficit for 2022 was approximately $1.4T for a budget of about $6T, which means that we increased our debt by about 4.4% in 2022.

The last time we had a budget surplus was 2001, when the surplus was $130B. After that, two things contributed to create significant deficits (from $160B to $450B) from 2002 to 2008: major tax breaks instituted by the Bush administration and the Afghanistan and Iraq wars.

The 2008 financial crisis increased the budget deficit dramatically in 2009 to $1.42T and it slowly decreased after that until the Trump tax cuts in 2017 started another upward trend and the deficit reached $1T in 2019.

The last 3 years have seen a major increase in our debt due primarily to the impact of COVID. The deficit for 2020 was over $3T, and in 2021 it was $2.8T (double that in 2022).

The current debt is approximately 125% of the national GDP (Gross Domestic Product). Our interest payments on this debt are about 15% of our spending. But it is interesting to note that only about 25% of those debt payments go to foreign investors. The rest is either intragovernmental or paid to US institutions, mutual funds, bond holders, etc. Compared to other developed nations, the USA is near the top in terms of ratio of debt to GDP, but not the highest. Japan wins that award at over 230%! For comparison, Italy has 135%, France 98%, the UK 80% and Germany 60%.

Yet American investments, securities and currency are still the most desirable in the world. So clearly the world doesn’t yet view the USA as having a huge debt issue or any type of impending disaster. But most economists seem to feel that we must work to limit or even reverse debt growth as we face a more challenging period of social security and Medicare expenses from an aging population, as well as likely growth in defense spending.

The budget deficit can be decreased by spending less and/or taxing more. There is always waste in government. The passionate feelings that fiscal conservatives have about reducing government are not unreasonable, but they run into hard numbers of required spending pretty quickly.

Social Security is $1.2T and Health Care (Medicare, Medicaid, Children’s Health Insurance Program and Affordable Care Act subsidies) come in at $1.4T. Along with some other mandated costs they make up about 65% of our $6T spending, and those costs will only increase as time goes on unless we are willing to cut them, which is generally a very unpopular concept!

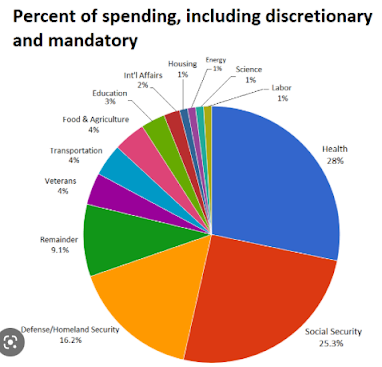

The defense budget is about 16% of the federal budget. Here is the overall breakdown of the federal budget.

And a more detailed look at discretionary spending:

I partly agree with the part of conservative thought that fears the steady, unexamined expansion of government. There is nothing evil about this expansion, it is simply entropy at work. It seems to me that there should be some bi-partisan group tasked with closely monitoring government spending and making recommendations to congress for reductions.

Admittedly, this would be a near impossible job and subject to all sorts of political machinations, but it is worth a try. The Congressional Budget Office (CBO) does some of this work, but more along the lines of estimating costs than analyzing the cost-effectiveness or value of government programs.

But no matter how much effort is put into attempts to reduce our current spending, it is highly unlikely we will be able to balance the budget in this manner.

With that in mind, let us look at taxation in the USA and see what can be done there! Here are some facts about taxes for the highest earners:

- Top 1%. (1.6M taxpayers) had average adjusted earnings of $1.6M per taxpayer and paid 25.6% in tax, or an average of $413k per taxpayer. The total of their taxes was $612B.

- Top 10% (14.8M) had average adjusted earnings of $380k per taxpayer and paid 19.9% in tax, or an average of $75k/taxpayer. Their total of taxes was $1.12T.

- The bottom 50% (74M taxpayers) had average adjusted earnings of $18k per taxpayer and paid 3.5% in tax, or an average of $653/taxpayer. Their total taxes were $48B out of a total tax revenue of 1.58T

The top 10% of taxpayers had a total of $5.6T in adjusted income (after deductions and all the legal maneuvering). If they paid another 10% in taxes, that would give the country $560B in revenue and would only decrease their average income from $380k to $342k. This additional tax could be structured in a graduated manner so as to have less effect on those down at the $200k-$400k level.

The effect of this additional taxation would be minimal in terms of the lifestyles of the wealthy. Opponents of tax increases believe fervently that increased taxation on the wealthy will somehow decrease investment and throttle growth. The top 10% of wage earners have so much accumulated wealth that it is very hard to imagine that they would limit their investments or somehow quit innovating or creating new companies.

I have seen many arguments by the Heritage Foundation and other conservative organizations framing the argument around share of taxation and income. They fall all over themselves pointing out that the rich pay a much higher share of taxes (71%) than their share of income (48%).

But this is looking at the situation backwards. The salaries and wealth of the rich are so large that they can afford to pay much more in tax and still have everything they need for their lifestyles and their business investments. In contrast, the poor and even the middle class struggle to keep their heads above water.

This is why large numbers of billionaires and multi-millionaires have declared their support for significant increases in their taxes. Increased taxes on the wealthy would also begin to move us away from the dangerously inegalitarian society that has developed over the last 40 years.

In the long run we will need to make significant changes in both our taxation and government spending. But the first step needs to be to increase taxes, both income and estate, at the upper end of the scale.

No comments:

Post a Comment